Last year’s announcement by Walmart that it was acquiring Cornershop operations in México and Chile for US$ 225 million generated a lot of expectations in Wall Street and most retailers in Latin America. In this article we will explore the impact this move might have for Walmart and the rest of retailers in the region.

What is Cornershop?

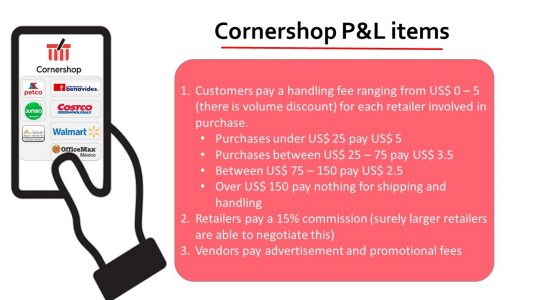

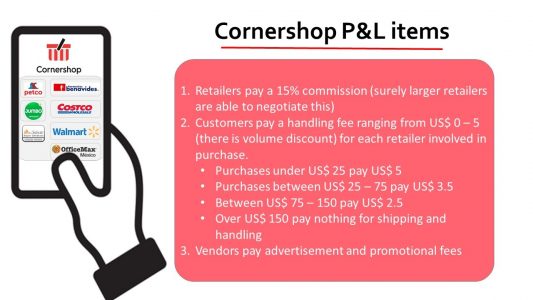

Cornershop is a fast growing online grocery delivery service, very similar to Instacart in the US, with operations in two of Walmart’s most promising international markets. Cornershop essentially offers customers a list of participating retailers from which they can order same or next day delivery purchases. Most deliveries are under one hour and a half within a 6 kilometer radius. Customers choose products from one or various retailers in the same transaction and pay Cornershop with a variety of digital payment options. Cornershop pays weekly the outstanding purchase balance to every retailer minus a 15% commission. Each order from a different retailer has a delivery charge ranging from US$ 0 – 5 (please see infographs below). Orders over US$ 150 are delivered free of charge. Cornershop Pop is a membership service where for US$ 90 shoppers can get free deliveries for purchases over US$ 30 (and US$3 per delivery under that threshold).

Each retailer is responsible for uploading their own product catalogue and setting prices. Some retailers, like Chedraui, only upload their premium product catalogue (Chedraui Selecto) which is presumably higher margin. Most, like Walmart, offer the same prices as those in store. Costco, notably, has a service charge 16-18% included in the price.

Cornershop then crowd sources the picking, selection and delivery to a pool of enrolled ‘personal shoppers’ who are also responsible for customer delivery. Each shopper is paid an average US$ 3-5 per hour (compare to the US$ 0.80 per hour established minimum wage). Shoppers can have phone contact with customers to agree on alternate or substitute products when faced with in-store out-of-stocks.

What is Cornershop’s business model?

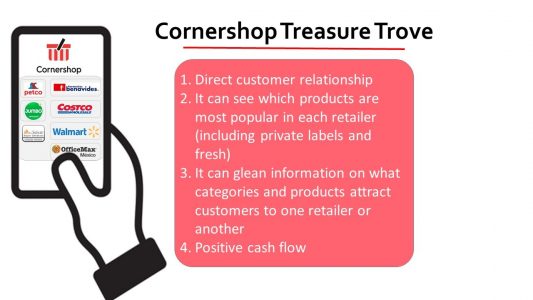

Cornershop’s main source of income is the 15% retailer commission on retailer sales. The delivery charges mostly go towards paying the personal shoppers for their work. The advertising and promotion revenue paid by vendors are icing on the cake. The platform generates a lot of shopping behavior data mining opportunities. Cornershop not only knows which retailers and stores are most popular for specific customer demographics but the drivers as well (price differentials, presence of key competitors, specific products, etc). It also knows which products, including private labels and fresh) are most popular for each retailer and response rates for vendor promotions. This data could then be leveraged to improve commercial strategies

Why did Walmart acquire Cornershop?

Walmart wants to preempt Amazon or Alibaba moving into its most profitable international operation. Cornershop gives it an instant logistics and customer interface vehicle towards gaining critical mass in grocery online sales. It is an increasingly popular platform in Mexico and Chile with significant growth potential.

What is going to be the most likely response from its competitors?

The most likely response from Walmart’s direct competitors that are in the Cornershop platform will be to withdraw from it. Competitors like Chedraui, Costco, Cencosud, Petco, Office Max and even Farmacias Benavides will not take lightly that Walmart has gained an insider look at a treasure trove of data regarding their most popular products, private labels and pricing strategies. Moreover, they will want to refrain from driving their competitor platform popularity.

Smaller retailers or those who do not feel threatened by the Walmart move (restaurants, fast food, etc..) will most likely continue unfazed and most likely help grow the Walmart-Cornershop ecosystem.

What is the key take away?

Walmart is signaling to every stakeholder and competitor its seriousness about competing head on against Amazon and Alibaba. Cornershop’s business model is consistent with Walmart’s philosophy of offering same online as in-store prices and perhaps charge for small purchase deliveries (whether through ‘Cornershop Pop’ or straight delivery charges). It is a smart pre-emptive move. As opposed to the US market, Walmart is thus leading the charge in online grocery sales in Mexico, Chile and Central America, which is again their most profitable international region.

I still believe however, that Walmart should not lose its focus on their key demographic: lower income shoppers for whom either the delivery or ‘Pop’ charges are too high to be affordable. This implies that for most of their customers, fully developing the ‘click & collect’ model is even more attractive and offers more potential than ‘home deliveries’.

For the remainder large Latin American retailers, and especially those forced to abandon the Cornershop platform, I urge they develop their own online grocery sales capability based on the ‘click & collect’ model. If you want to learn more about this, please read my article ‘If you are not Amazon or Walmart, this is your best chance to catch up’. This development has to be based on third party software, robotics and logistic suppliers. There is a myriad of companies that can offer turnkey solutions saving time and resources that were wasted in the past. The silver lining is that this will force them to re-establish a direct relationship with their digital native shoppers. As Brittain Ladd has brilliantly argued in ‘Shake up in aisle five: will grocery retailers abandon Instacart?’ it was never a good idea to hand over that relationship to a third party.

Jean-Marc François is a highly evaluated Guest Professor of IESA (Caracas), Uniandes (Bogotá) and INCAE (Costa Rica) where he teaches Strategic Retail, Omni Channel Marketing and Trade Marketing. He is a recognized speaker and consultant and leads his own market information firm Real Audit. Mr. François has more than 25 years’ experience leading and managing projects in over 26 countries worldwide for companies like Pfizer, DIAGEO, Groupe Casino, Grupo Éxito, Pepsico, BAT, Nestlé, Lilly, Oracle, SAP among many others. He is fluent in English, French and Spanish. He competed in swimming in the 1980 Moscow and 1984 Los Angeles Olympic Games.