Clorox has been a staple of many portfolios and has provided exceptional returns.

The company has seen slowing growth but remains a best of breed consumer package goods company.

The shares have drastically outperformed peers and now offer a high P/E and low yield versus its sector.

The Clorox Company (CLX) has proven itself a worthy investment for long-term shareholders. While I initially sold my shares last year after a nice quick gain, I would still like to become a shareholder once again. Still, shares appear to be overvalued and offer little yield versus peers. While consumer packaged goods companies typically fare better in recessions and underperform in bull markets, they offer a sleep-well-at-night feeling for most investors. Additionally, seeing the products you use and others using them as well give a sense of pride in the investment. Investors looking for a consumer goods company at this time may find better alternatives elsewhere or would be best sitting on the sidelines if it is Clorox shares they want.

Performance Seeing Pressure

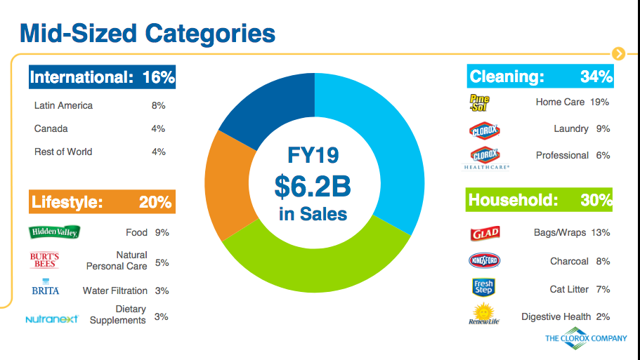

The Clorox Company is most well-known for its namesake brand, but it happens to own many brands that are leaders in their categories.

Source: Earnings Presentation

Source: Earnings Presentation

With #1 or #2 market share in every category it operates in, the company continues to have the ability to raise prices and maintain relationships with its customers.

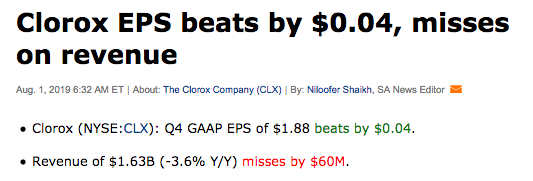

Clorox has performed well at a time when peers have faced declining sales and profit margins. However, it appears even Clorox can’t avoid the decline in consumer packaged goods and it showed recently.

Source: Seeking Alpha

Source: Seeking Alpha

With Clorox reporting a miss on revenue, investors should realize Clorox isn’t immune to what is happening. The company reported a 4% decline in revenue, including 2 points of negative impact from foreign currency headwinds and a 3-point decrease in volume. This was partially offset by the benefit of price increases that saved it from being down 5%. As I noted before, many companies of this size and distribution have seen product sales decrease as the consumer starts to switch to non-branded alternatives. It just seems to have taken longer to affect Clorox than peers.

Impressively, Clorox was able to see margin expansion in the quarter. Most consumer goods companies right now face margin pressure. The company’s fourth-quarter gross margin increased 110 basis points to 45.1% from 44.0% in the year-ago quarter. The increase in margin was driven primarily by price increases and cost savings, but was negatively affected by higher trade spending as well as higher manufacturing and logistics costs. This metric has been of utmost importance in other consumer goods companies. The declining margin means despite the ability of the company to grow sales it is generating less profit dollars than before for the same $1 of sales. With that type of pressure the company needs to significantly grow sales in order to keep increasing profits to investor expectations. However, in this case Clorox was able to increase margin on declining sales which helped prop earnings up for the quarter.

The company continues to have a well-balanced portfolio of products in a variety of consumer categories.

Source: Earnings Slides

The limited international exposure helps ensure growth as the American domestic economy has been strong.

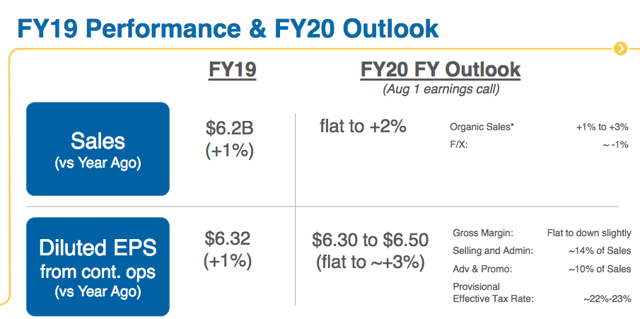

The company did issue lower than expected guidance for the year to an estimated $6.30-6.50 per share.

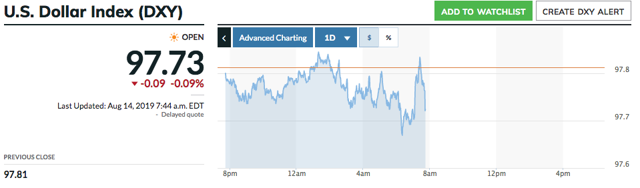

As we can see this growth is either flat or slightly positive. With the recent continued strength in the dollar, international sales could cause further earnings pressure and the company could face another reduction in earnings guidance in the future.

Source: Market Watch

Source: Market Watch

Nonetheless, the earnings estimates as they stand do not appear to be any stronger than others in the space.

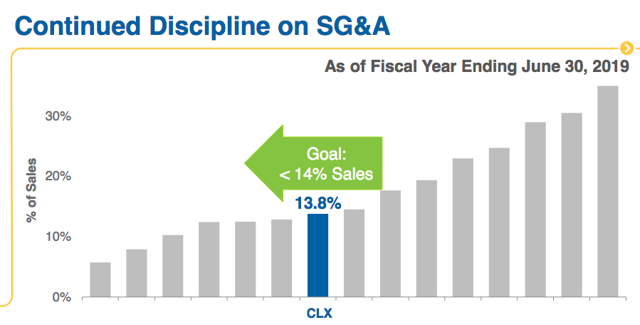

The company identifies with the following peers and is quick to recognize its low percentage of spend related to revenue on selling, general, and administrative costs.

The important part to note is that this is in the middle of the pack not the best or the worst, and we now can properly compare to which peers Clorox considers itself in the same group as.

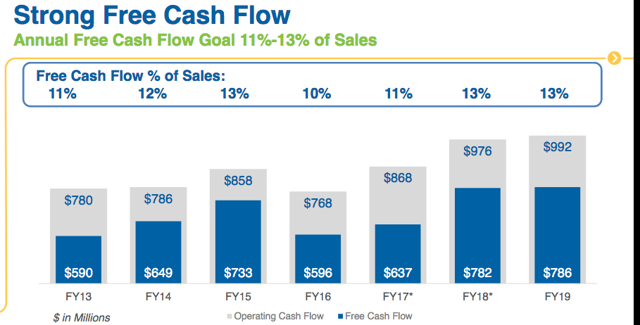

Lastly, the company has strong cash flows that allow it to continue to make smart acquisitions, increase dividends, and authorize buybacks.

Investors should maintain an eye on these levels as the cash flow could begin to see pressure from the sales declining or some pressure on margins. As I said 3 quarters ago, there is only so much cost savings the company can continue to find before it starts to negatively affect sales. Sure enough it appears this is happening.

Valuation

Taking a look at valuation, we can see how the company compares to the peers it has identified itself.

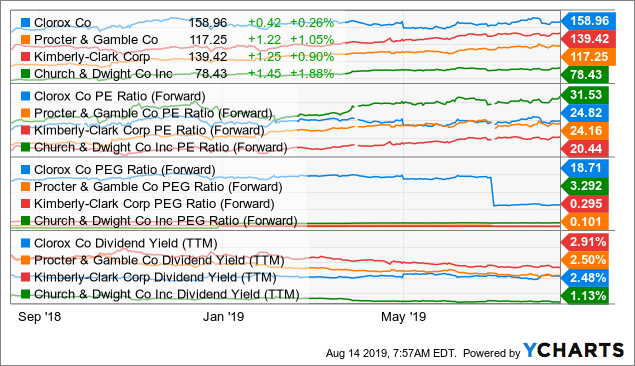

Data by YCharts

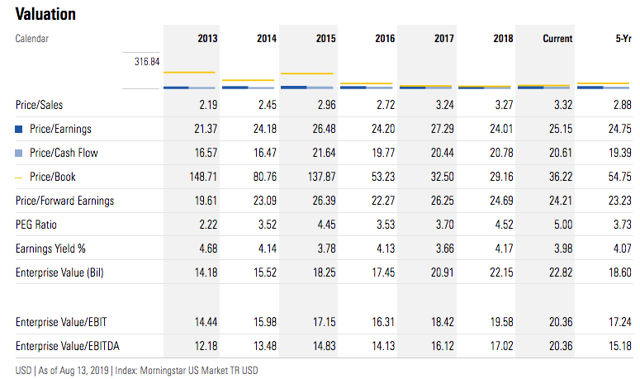

Data by YChartsWhile competitor valuations have increased much faster in the last three quarters, Clorox’s valuation has remained the same. Despite this, Clorox trades with the second-highest forward P/E in its group and yet it has the highest PEG ratio. The yield is also not that appealing at 2.48% on a TTM basis and at 2.67% currently. The dividend, however, is well covered as the payout ratio currently is only 63% of cash flow.

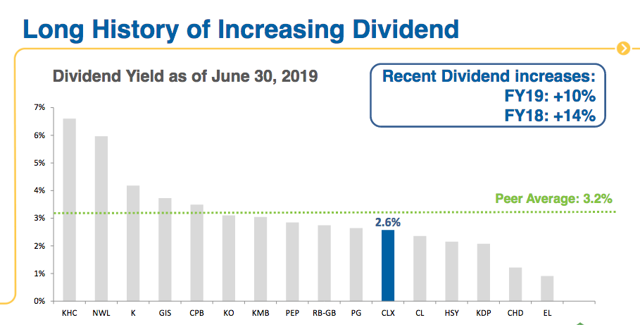

As we can see, Clorox points out that it has a lower-than-average yield compared to peers. Even when accounting for the 42 years of dividend raises, it remains quite low. Furthermore, looking at the valuation compared to its own history we see the following.

The company trades at a premium to its 5-year average P/E ratio, P/S ratio, P/CF, forward P/E and PEG ratio. On almost every measure it is more expensive now than in the past 5 years to purchase shares of Clorox. This would be a bit more reasonable if the company was experiencing a faster pace of growth or more favorable conditions but that is not the case.

Lastly, we take a look at the DCF valuation to see if there is room for safety in the shares.

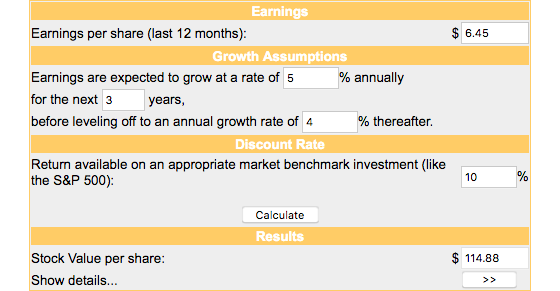

Source: Money Chimp

I decided to use a forward-looking basis and use the middle point of what earnings per share are estimated to be in the coming quarters. This gives it a more than fair assumption along with the accelerated growth rate for the next 3 years, which the company has not identified as possible. With these lofty expectations given guidance and current market conditions, the DCF value is only $114.88 per share or about 28% lower from where shares currently trade at $158.

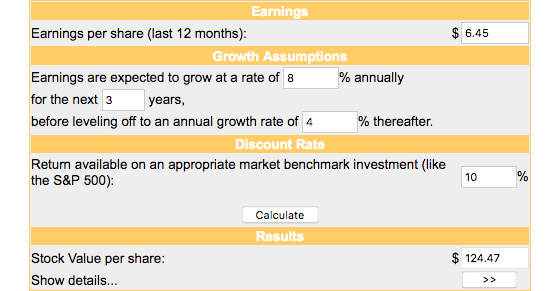

Next, I tried an even more rosy scenario with the company growing 8% for the next 3 years followed by 5% thereafter.

Yet the DCF value is still more than 21% lower than the $158 share price.

It appears no matter which way investors decide to look at Clorox stock that the shares are overvalued. There is no fundamental metric in which the shares appear to be appealing at this time. For this reason we stay on the sidelines.

Conclusion

For investors looking to add shares of Clorox to their portfolio, now is not the time. There certainly could be weakness ahead considering the further strengthening of the dollar and that the company produces 16% of its revenue from international sales. With any further increases in costs due to such things as driver shortages, wage increase, and interest rates rising, the company will continue to see a rise in costs. With many consumers losing brand loyalty interest, Clorox may have a thin line to walk on before consumers decide any price increase used to absorb rising costs are no longer worth purchasing the company’s brands. Generally, risks are low when investing in a company that produces items consumers use every day. However, the risk rises when the share price doesn’t meet the fundamentals. While I believe Clorox will perform fine in the future, I do believe that the shares will offer a better entry point once investors become unimpressed with results. Additionally, as interest rates rise, there will be further competition for the company and its already low yield. Paying 25x earnings for a low or no growth corporation with a yield lower than 2.7% quickly loses appeal. While investors can sleep well at night knowing Clorox is not going out of business, they should recognize the risk that the currently elevated share price has and avoid purchasing the stock for now.