Starbucks reported Q1 earnings which were overshadowed by the developing coronavirus epidemic in China.

Starbucks announced it has closed more than half its China store locations with no timetable to reopen.

We estimate the company is losing $4 million to $5 million in sales per day, which over a two-week period could pressure firm-wide Q2 revenue growth by 1.2%-1.5%.

While the company reiterated full-year guidance, we expect the estimates to be revised sharply lower as the full extent of the impact in the region becomes clear.

Starbucks Corp. (NASDAQ:SBUX) just reported fiscal Q1 earnings with non-GAAP EPS of $0.79, which beat expectations by $0.03. Revenue of $7.1 billion in the quarter, up by 7.1% year or year, was essentially in line as it missed the consensus estimate by just $10 million. While the report was overall solid, the story has been overshadowed by the ongoing coronavirus headlines out of China which remains the key growth market for the company. Fears of a spreading epidemic forced Starbucks to close over 2,000 store locations in the country, or nearly half its current store count. The stock is down by 6% in the past week and likely to be pressured going forward with a mounting financial hit along with weak sentiment towards the outlook.

(Source: Finviz.com)

Q1 fiscal 2020 recap

Starbucks reported another strong quarter with a combination of continued global comparable store sales momentum which increased by 5%, driven by a 3% increase in average ticket and a 2% increase in comparable transactions. Impressively, the U.S. comparable store sales were up 6%, with comparable transactions up 3%. International comparable store sales up 1%, driven by a 2% increase in average ticket while transactions fell 1% year over year. The results were more positive in China where comparable store sales increased 3%, with comparable transactions up 1%.

The company continues to expand aggressively worldwide and opened 539 net new stores in Q1, bringing the total to 31,795 stores at the end of the quarter, a 6% increase over the prior year. In the U.S., the company highlighted its rewards program membership, the «Active StarbucksRewards» reaching 18.9 million customers and up 16% year over year. These customers are expected to spend more on average and support margins going forward.

The company curiously reaffirmed full-year fiscal 2020 guidance that was previously issued with the fiscal Q4 results back in October despite acknowledging it excludes any impact from coronavirus. For the year, management sees global comparable store sales up 3% to 4% while planning to add 2,000 new stores for the year. EPS target in a range between $3.00 and $3.05 if confirmed at the midpoint would represent an increase of 6.7% compared to 2019. We expect these estimates to be revised sharply lower when they are updated. At risk are the sales growth and EPS targets in particular.

Coronavirus Impact to China Business More Recently

As mentioned, the quarterly report was upended by the ongoing coronavirus developments in China which intensified over the past week. Management included comments in the press release indicating the company temporarily closed «more than half» of its stores in China. With a current store count of 4,292 in the country, the total implies at least 2,150.

Currently, we have closed more than half of our stores in China and continue to monitor and modify the operating hours of all of our stores in the market in response to the outbreak of the coronavirus. This is expected to be temporary. Given the dynamic nature of these circumstances, the duration of business disruption, reduced customer traffic and related financial impact cannot be reasonably estimated at this time but are expected to materially affect our International segment and consolidated results for the second quarter and full year of fiscal 2020. The company will update its guidance for fiscal 2020 when we can reasonably estimate the impact of the coronavirus.

The China region generated $745 million in revenue in the last quarter, representing about 11% of the firm-wide $7.1 billion total in Q1. We estimate that the company is losing about $4.0 to $5.0 million in sales per day with half the stores closed. We calculate this estimate by extrapolating the Q1 quarterly sales figures by the number of calendar days in a quarter, $745 million over 91 days. For context, this is a relatively small amount of the firm-wide total for any given day. The problem, however, is that the length of the closures is unknown with a presumption that it will last a few weeks at least.

(Source: Company IR)

Even when and if stores reopen, it’s likely traffic and sales will take some time to normalize and there will be disruptions across the full network. Depending on how the coronavirus epidemic evolves, it’s possible the closures could be expanded to more stores in China or other countries in the region. Indeed, the company sees a material effect on the international segment and consolidated results for the fiscal quarter as per the quote above.

Analysis and Forward-Looking Commentary

In a best-case scenario, the ~2,100 stores could reopen in two weeks and the lost revenue would be in the range of $60-80 million representing a 10%-15% drop in quarter-over-quarter China sales. Considering the current market consensus estimates for Q2 sales of $6.57 billion, a two-week closure of half the China stores would represent a ~1.2% to 1.5% impact to the firm-wide quarterly result.

Considering current consensus estimates for firm-wide Q2 revenue growth of 4.2%, our estimate implies six weeks of store closures at the current rate would result in a year-over-year decline to Q2 revenue. The impact on earnings would likely be more severe. There is also the planned store openings that are likely to be delayed during this period, further pressuring the quarter’s result.

In a worst-case type scenario, the coronavirus epidemic intensifying could result in Starbucks closing all stores in the country for the entire quarter which would have broader and more serious implications to global financial markets. The situation in China remains fluid and it’s simply speculation to guess when stores will reopen and the full economic impact to not only Starbucks but also China and the global economy. Our take is that the market remains complacent to the ongoing coronavirus risks based on the rally in broad market indexes in recent days once again approaching all-time highs.

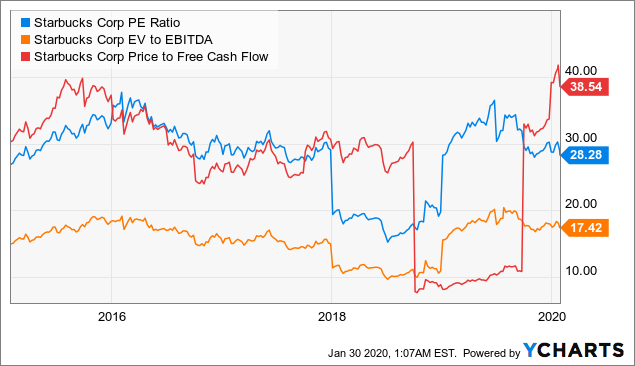

The other consideration here is a valuation for the stock that remains at elevated levels relative to the Starbucks historical averages. With current P/E of 28.3x and EV to EBITDA multiple of 17.4x, the stock has hardly sold off enough with the latest developments to reach a value category. We think the stock should trade lower as it prices in the risk that the full-year guidance estimates are still too aggressive and will need to be revised lower. We see the stock trading down to $75 as a near-term price target this year.

Data by YCharts

Data by YChartsTakeaway

While the company reported an overall solid Q1 earnings report, the real story was the closure of half the store base in China as a response to the ongoing coronavirus epidemic. We think the market remains complacent with the still developing and complex situation that represents several operational and financial risks for the company. We expect the stock to remain under pressure with a poor sentiment in the near term until there is more clarity on the extent of the impacts and how the company plans to move forward.