J.C. Penney’s Q3 2018 results involved both significant declines in comparable store sales and gross margins.

It did previously indicate that Q3 results would be fairly weak as it tries to clear up its inventory situation again, but the results were still weaker than expected.

Fixing clearance margins may get overall gross margins back to the 35% to 36% range.

J.C. Penney’s stock appears to have already factored in challenging results.

It probably has a couple quarters grace period before it needs to start showing some improvements under Jill Soltau.

Looking for a community to discuss ideas with? Distressed Value Investing features a chat room of like-minded investors sharing investing ideas and strategies. Get started today »

J.C. Penney’s (JCP) Q3 2018 results indicate that the company is still dealing with significant challenges around sales growth and gross margins. These challenges have been going on for a while and J.C. Penney did note (in its Q2 2018 earnings call) that its Q3 2018 results would be fairly weak as a result. The actual results for Q3 2018 involved comparable store sales that fell significantly more than expected though, leaving new CEO Jill Soltau with much work to do to turnaround J.C. Penney.

Declining Comparable Store Sales

The -5.4% comparable stores figure for Q3 2018 was very weak and marks its worst result since Q2 2013, when it was in the early stages of trying to recover from the Ron Johnson era. This does come against a tougher Q3 2017 comp (of +1.7%), which was influenced by J.C. Penney’s liquidation of inventory during the quarter.

Adjusting for J.C. Penney’s estimated benefit from that liquidation would change J.C. Penney’s comps in Q3 2018 to approximately -4.0%, while the calendar shift also affected comps by another 0.9%. Adjusting for that would result in an estimate of -3.1% comps for J.C. Penney, which is better than what it first appeared to be, but still weak. J.C. Penney had mentioned that its Q3 2018 comps were expected to be slightly negative, but these results are probably several percentage points worse than expected.

J.C. Penney’s comps are now at -1.7% for the first three quarters of the year and it now expects comps to be down in the low-single digits for the full year.

The full year guidance change for comparable store sales doesn’t tell us much about Q4 2018 expectations though since it would take around +3.3% comps in Q4 2018 for full year comps to reach 0% and around -8.5% comps in Q4 2018 for full year comps to reach -4%. Anything in between -8.5% to +3.3% in Q4 2018 would probably result in a full year number that would count as down low-single digits.

Gross Margin Challenges

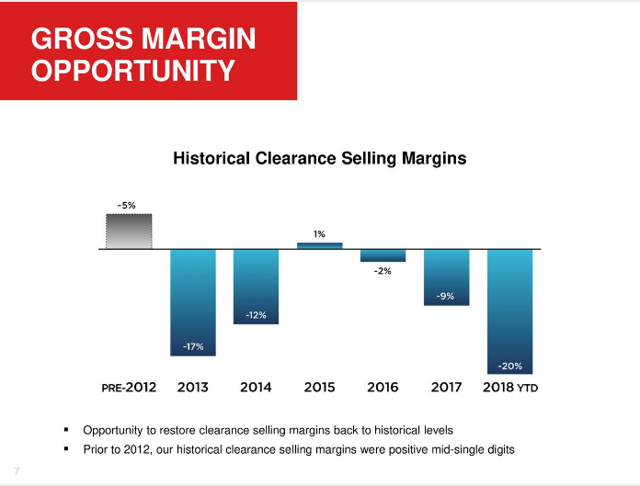

J.C. Penney’s gross margins also ended up being poor at 31.9%, largely due to «planned markdown and pricing actions taken in the quarter to clear slow-moving and excess inventory». J.C. Penney noted that non-clearance margins were up compared to last year, but the need to clear slow-moving and excess inventory seems to be a recurring theme. J.C. Penney had indicated during its Q2 earnings call that gross margins would be weak during Q3 (mentioning 150 basis points of gross margin compression), but its gross margin ended up 200 basis points below Q3 2017 levels.

If J.C. Penney can get its clearance selling margins back to 2015/2016 levels though, it should be able to get its gross margins back up to 35% to 36%.

Source: J.C. Penney

That would require better inventory management, which J.C. Penney has had trouble with since early 2017, but perhaps the changes in senior management will result in a better outcome going forward.

The improved results in 2015 and 2016 indicates that the clearance selling margin issue is probably fixable despite a couple years of clearance selling significantly below cost.

Conclusion

J.C. Penney’s results for Q3 2018 were pretty weak, with gross margins and comparable store sales falling short of already lowered expectations. It mentioned that there will still be some gross margin and comps pressure in Q4 2018 as well, while its inventory situation (affecting gross margins) may not be fully cleared up until mid 2019.

The rebound in J.C. Penney’s stock after earnings indicates that J.C. Penney may get a pass for a couple quarters until Soltau’s impact on the company can be more fully seen. J.C. Penney probably just needs to keep its comps decline to the low-single digits and gross margins from going even lower in the meantime.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about J.C. Penney and other companies along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

Disclosure: I am/we are long JCP.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.