Bed Bath & Beyond’s Q3 results looked great on the surface.

The enormous $1B cash position gives a false sense of security.

Declined gross margin and net margin expose deep operational problems.

Much of its healthy cash addition in the quarter was a result of non-operational adjustments.

Despite seemingly undervalued, investment in the company today does not guarantee long-term returns.

Investment thesis

Bed Bath & Beyond’s (BBBY) Q3 headline revenue and earnings results were satisfactory. The enormous $1B cash position reassured investors the company has a long runway to optimize the business. Also, the subsequent announcement of the company’s experiment to find next-gen stores also demonstrated a sense of urgency and that drastic transformation was well underway.

The initial surge in the share price by 20% after the earnings announcement infers that Q3 results were indeed satisfactory. However, we beg to differ after a careful reading of the results.

We also want to remind investors that, in the short term, there is little correlation between the success of a company’s operations and the success of its stock. However, in the long run, the correlation should be 100 percent.

In our opinion, Bed Bath & Beyond’s Q3 results failed to demonstrate clearly the long-term future of the company. Thus, while we pick out negatives, or the lack of progress, at the minimum, we encourage investors to question the management expectation of the company recovery in 2019 and 2020.

Lastly, it pays to be patient, but only when you own shares of successful companies. BBBY has grown out of its first store in New Jersey from the ‘Bed n Bath’ days in 1971. However, recent performance has shown that the company is struggling to keep its current 1.5K+ stores relevant. The only thing that keeps the company going is its strong balance sheet and its heavy discounting strategy. Without real signs of recovery or a viable strategy for the future, we find investing in BBBY more suited to investors with a very long horizon and a strong stomach for volatility.

Q3 results

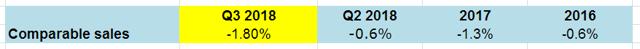

For full details of the results, investors can refer to the presentation and earnings call. Briefly, BBBY posted -1.8% comparable sales, 2.6% net sales increase and $0.18 EPS. The quarterly dividend was increased by 1 cent to $0.16/share, and $8M worth of shares were repurchased.

Source: BBBY Q3 results presentation 09 Jan. 2019

The summary of the results above shows a good quarter supported by a rock-solid balance sheet. By far, the enormous cash position was the most surprising point. New investors would instantly see that the amount is 63% of the current market cap. It provides important mental security for investors to venture in troubled companies and industries. As we know, the biggest losses in stocks come from companies with weak balance sheets. Even with the debt balance of $1.1B, the setup at BBBY strikes the company out of this risk.

Before diving in the negatives, we were pleasantly surprised by how focused the management was on the long term. In troubled times, this is imperative.

Focused on the long term

The management repeatedly reminded analysts in the conference they are committed for the long game. Some of the extracts were (emphasis added):

We are making in transforming our company and believe we are currently ahead of plan. This reflects some of the adjustments we have been making as we pursue our long-term strategic goals. As we discussed during our last call in September, we have been managing our business with a stronger bias towards prioritizing profitability above sales growth to put us in a better position to reestablish earnings growth.

[…]

In the long run, BBBY will be a smaller retailer but a more profitable one.

[…]

And overall, we expect to operate fewer stores while continuing to drive profitable digital growth, all supported by an efficient corporate structure.

Source: BBBY Q3 conference call, Jan 2019

What were the negatives

Low conviction

While we are elated that the management seemed focused on the long term, action speaks louder than words. Indeed, investors can view the following point both ways. We tend to be more cynical.

During the quarter, the management repurchased approximately $8 million worth of shares, representing a little more than 0.5 million shares. The amount is insignificant to the current market cap and buyback amount in the past.

This action shows that the management has little conviction for the future and that the worst period is yet to come. The small stock repurchase may also indicate that they were cautious. Possibly, they wanted to retain resource for the transformation plan.

We tend to agree to the former. If the management were committed to transforming the company, they would have increased or shown intentions to spend more on CAPEX, staffing and marketing. Instead, CAPEX remained conservative, payroll decreased, and marketing was incremental.

Little progress on optimization

Despite strong digital sales, comparable sales declined 1.8%. The figure tells BBBY stores were struggling during the quarter.

Source: BBBY financials, Authors’ work

We would also pay little attention to the claim that the ‘Lab stores initiative’was progressing. When asked, the CEO couldn’t pin down on what was working and what was not in these experimental stores. Additionally, it could also well be that these chosen stores were better-performing stores, making any performance comparison less salient.

Worse, we think that the decline in the comparable sales for the fourth quarter will be higher than the -1% that the management was expecting. Remember that much of the 2.6% increase in net sales for this quarter was shifted from Q4. In the absence of this 2.6% shift, it is highly likely that Q4 comparable sales will be worse than this quarter. Nevertheless, our guesses of a precise number are as good as yours. As far as we can see from this quarter, deeper problems lie ahead.

Deeper problems

In the past, BBBY was criticized for relying heavily on coupons as a ‘nudge’ to entice customers through the door. While the 2.6% increase in sales in Q3 was encouraging, the strategy is not a long-term solution.

During Q3, despite a higher amount of coupon was offered to customers, redemption fell. Said another way, despite the incentive, customers were still uninterested in BBBY’s products. Additionally, we would have thought that the smaller coupon redemption would have helped gross margin, but it didn’t.

In Q3, gross margin and net margin continued their decline. Gross margin dropped to 33.1% from 35.2%. The management blamed coupon and loss of its buying power as its merchandize margin fell. Net margin also dropped to 1.65% from 2.10% compared to Q3 last year. This fall is concerning considering it has accounted for the $28M gain from the sale of a building offset by $26M of advertising spent transferred from Q4 to Q3. A net benefit of $2M, but overall, the sale of the building is one-off. Thus, truthfully, the net margin could have been even lower than the 1.65%.

Furthermore, lower tax also helped the bottom line. All in all, operationally, BBBY did not improve but deteriorated.

Sure. So, we did have a sale of the building in the quarter and we talked about it last quarter and it did represent $0.16 on the quarter. But also we had the acceleration of our advertising expenses from our revenue recognition accounting standard move into the third quarter as well. So, those two essentially offset each other and we have provided visibility to those items on our call last quarter. And then as far as the – sorry as far as the full year guidance, the $2, it does include the impact of this gain on the sale of the building.

Source: BBBY Q3 conference call, Jan 2019 (emphasis added)

One niggling detail that we did not like to see was the drop in payroll. In the midst of an organizational change, high employee morale and motivation are crucial. However, a reduction in their salary will likely induce resistance to change.

Other worthy mentions

A 6% reduction in inventory was commended and attributed to successful optimization strategies. Again, we beg to differ; the 6% reduction could very well be the fact that BBBY simply bought less stock compared to last year, $279M vs. $290M worth of merchandise. The increased sales from shifting the post-Thanksgiving week to the quarter would also have played a part here.

BBBY reported an enormous cash increase of $416M. Running through the cash flow statement and we could see that it was thanks to $11M less cash spent on merchandise, $19M increase in depreciation, $90M increase in accounts payable, $8M less spent on CAPEX, $123M less spent on share buyback, and a $29M gain on sale of a building. While all are great items, none indicates an improvement of the core operation. The total benefit here amounts to $280M, a significant amount of non-core cash adjustment that has made the net cash increase of $416M magical.

Lastly, we feel the following extract from the conference call indicates that the management couldn’t pin down to any specifics that made the said improvements convincing.

Josh Kamboj

Hi. This is Josh Kamboj on for Simeon. Thanks for taking my questions. In 2019’s guidance, what is improving more than you expected todayversus sort of is there anything that you might be pulling ahead in terms of strategic plans that you earlier would have done later on after next year?

Steven Temares

Yes. From my perspective and I guess, everybody could have their perspective on it because it’s across a lot of different line items and a lot of things we’re doing in the company, but for me is that just – we’ve been – spent a lot of time and effort reinventing our company. Our earnings peaked I think in what was its February 2015 on an earnings per share basis and we’ve been reinventing the company. We’ve been investing heavily in our company over this period of time. And the things that we’re doing, we’re now – they’re taking root and we’re seeing these things take root and we’re seeing the ability to be more optimistic earlier we felt comfortable with 2020, now we’re saying earlier. So that’s what we’re seeing today. But it really is a long – everything we’re doing, when we talk about the things we’re doing from an assortment perspective or the things we’re doing from a digital perspective or the marketing we talked about the things we’re doing from personalization, when we talk about the technology enhancements, our enterprise order management system, our human capital management system, we talked about the things we’re doing with Revionics and our value optimization group, rolling out the point of sale, the workforce management. There are so many things that we put into place that now we’re starting to see and we’re getting the cadence of when we’re going to get these benefits, so it allows us to be we’re closer to that timeframe, it allows us to have greater visibility and so that’s a shorter term, so that’s where we’re at.

[…]

I mean, we’re ahead of plan as far as what I just said. Our long-term planning was that we would have a decrease in EPS this year, a decrease next year and then starting to see growth the year after. We’re seeing it quite ahead of plan because we’re planning preliminary not to have that decrease next year that we’re going to start to see improvements enough to be able to flatten out the EPS next year.As far as the baby business, it continues to do well. We’re unless competitive in the market with Babies»R»Us not being a business. And so the baby business across the Bed Bath & Beyond side, baby side, baby stores continue to perform well.

Source: BBBY Q3 conference call, Jan 2019 (emphasis added)

One thing to be clear, BBBY has not invested significantly on CAPEX since 2015 to substantiate Steven Temares’ statement above. If anything, their digitalization endeavor had only really begun a year ago.

Takeaways

To conclude, BBBY Q3 results looked better than they are. The top line was better because of the shift in sales from the post-Thanksgiving week, and gross margins declined by over 2% yet had little mention in the conference call or company’s presentation. We think the management is dodging the fact that BBBY has lost its bargaining power. The enormous cash balance was positive, but a considerable amount of it was due to non-operational adjustments and unlikely to sustain in the long-run. Inventory seemed well managed with 6% fall in inventory. However, part of it was probably due to the smaller purchase of stocks and also the shift of sales from Q4 as previously mentioned.

The only good thing we could take from this quarter was that the management seemed more focused on long-term performance than short-term objectives. Nevertheless, they must have felt the rocky road is ahead to have repurchased only $8M worth of shares during the quarter.

Q3 headline results and $2 EPS estimates created an illusion of an undervalued investment. In light of the deep issues discussed, we urge investors to look beyond the headlines and question management’s rosy guidance for 2019 and 2020.

Finally, if you’re thinking about investing in a troubled industry, buy companies with staying power. Brick-and-mortar retail is disrupted, and thus numerous value opportunities are on offer. We are just not sure BBBY is one of them. We don’t think the management is confident their strategy can transform BBBY to adapt to the new retail environment. Their low conviction was clear in their recent share repurchase amount and the token increase in the quarterly dividend payout. Q3 results also did not provide enough evidence to suggest the company is turning around. Consequently, we don’t recommend to invest in BBBY at this point. Waiting for the company to show signs of revival would be a safer bet.