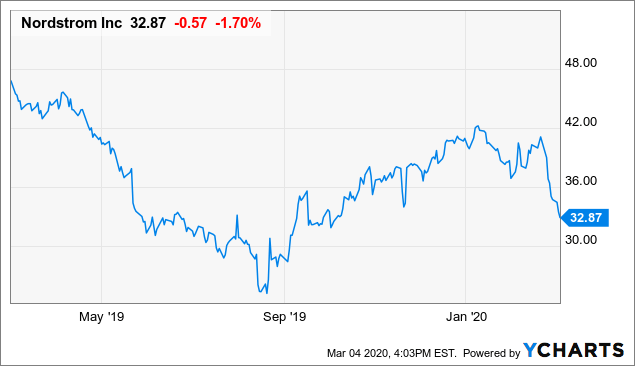

Nordstrom stock declined on Wednesday after the company’s Q4 results and 2020 earnings guidance fell short of expectations.

However, a big increase in non-cash expenses appears to be the main reason for Nordstrom’s apparently disappointing guidance.

Free cash flow is set to surge in fiscal 2020, rising to around $5 per share. That puts Nordstrom stock’s valuation at less than seven times forward free cash flow.

Nordstrom is a great buy-and-hold opportunity for long-term investors.

Investors weren’t happy with Nordstrom‘s (JWN) fourth-quarter earnings report. On Tuesday afternoon, the upscale retailer reported that earnings declined year over year last quarter and missed analysts’ estimates. The company’s earnings outlook for fiscal 2020 also came in below the analyst consensus.

Not surprisingly, this news caused investors to sell Nordstrom stock, adding to a coronavirus-related rout that had already knocked nearly 20% off the share price in less than two weeks.

However, while Nordstrom’s Q4 earnings performance was subpar, sales trends are improving sequentially. Moreover, the company remains primed for a sharp uptick in free cash flow starting in 2020, making the current dip in Nordstrom stock a great buying opportunity.

Sales trends improve but earnings decline

Nordstrom’s net sales rose 1.3% last quarter, while total revenue (including credit card revenue) increased 1.2% to $4.54 billion. This came in just shy of the average analyst estimate, which had called for a 1.8% increase in total revenue to $4.56 billion.

This sales growth consisted of a 1.8% increase in Nordstrom’s off-price business and a 1.0% uptick on the full-price side of the business. Both parts of the company saw sequential improvement in sales trends (see slide 13). The 1% full-price sales increase compared to a 4.1% decline in the third quarter and a 6.5% plunge in the second quarter. Meanwhile, off-price sales growth accelerated to 1.8% from a 1.2% increase in Q3 and a 1.9% decrease in Q2.

That said, Nordstrom’s full-price business was facing an easy year-over-year comparison last quarter and benefited significantly from the opening of the main Nordstrom Manhattan flagship store near the end of the third quarter. That makes the 1% sales increase seem underwhelming. Additionally, the Nordstrom Rack off-price chain isn’t growing sales nearly as quickly as pure-play off-price retailers.

The more disappointing aspect of Nordstrom’s earnings report was its profitability, though. Adjusted operating profit declined slightly to $331 million last quarter, compared to $333 million a year earlier. By contrast, Nordstrom had expanded its adjusted operating margin by 50 basis points in the third quarter.

While operating profit was roughly flat year over year in Q4, higher interest expense and a higher tax rate more than offset the impact of a lower share count. As a result, Nordstrom’s adjusted EPS fell 4% year over year to $1.42. Analysts had expected $1.47, on average. On a full-year basis, adjusted EPS reached $3.37: in line with the company’s most recent guidance of $3.30-$3.50 but down from $3.60 a year earlier.

No earnings growth expected in 2020

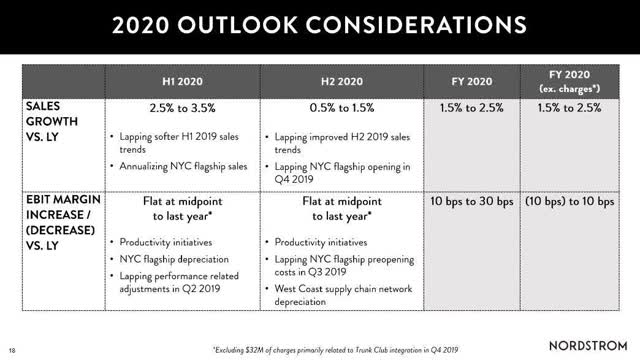

Nordstrom expects sales trends to continue improving this year, excluding any impacts from the current coronavirus outbreak. The company’s initial forecast for the year calls for a 1.5%-2.5% increase in net sales, which implies further acceleration compared to last quarter. This forecast is roughly in line with analysts’ expectations. Growth will be strongest in the first half of the year, when Nordstrom faces easy year-over-year comparisons and will not yet have lapped the late-October flagship opening.

(Source: Nordstrom Q4 2019 Investor Presentation, slide 18)

(Source: Nordstrom Q4 2019 Investor Presentation, slide 18)

On the other hand, management projected that full-year EPS will land between $3.25 and $3.50: roughly flat year over year. This compares unfavorably to the analyst consensus of $3.49.

The guidance is a lot better than it looks

While analysts and investors were hoping for better EPS results in fiscal 2020, they may not have fully factored in a big increase in non-cash expense filtering through to Nordstrom’s income statement this year.

First, depreciation and amortization expense is poised to jump, primarily due to the full-year impact of having the Manhattan flagship store open. The opening of a new West Coast fulfillment center will also contribute in this regard. Last quarter, depreciation and amortization expense increased by approximately $18 million year over year. If Nordstrom reports similar increases in this non-cash expense component throughout 2020, depreciation and amortization will represent a $72 million pre-tax earnings headwind this year.

Second, the opening of these two major investments (the flagship store and fulfillment center) will cause Nordstrom to capitalize less of its interest expense going forward. This doesn’t affect its cash interest expense, but it will increase the amount of net interest expense reported on the income statement by about $18 million this year (to $120 million).

Thus, these two items will increase non-cash expense by perhaps $90 million before taxes in fiscal 2020. That represents a roughly $0.40-$0.45 annualized drag on EPS: potentially the difference between no growth and double-digit growth.

Looking at free cash flow, Nordstrom’s outlook is far more positive. Nordstrom expects to produce approximately 2.5 times as much free cash flow in fiscal 2020 as the $309 million it generated last year. In addition to the increase in non-cash expense (which supports stronger cash flow growth than earnings growth), Nordstrom plans to reduce CapEx by about $300 million compared to fiscal 2019. This mainly reflects completion of the Manhattan flagship construction project.

(Nordstrom’s Manhattan flagship opened last fall. Image source: Nordstrom.)

(Nordstrom’s Manhattan flagship opened last fall. Image source: Nordstrom.)

This forecast implies that free cash flow will rise to around $750 million-$800 million this year: roughly $5 per share. There’s more room for improvement in the years ahead, as the profit contribution of Nordstrom’s recent growth investments ramps up. Nordstrom’s goal of expanding free cash flow to $1 billion by fiscal 2022 is ambitious but not out of reach.

Nordstrom stock is massively undervalued

Just based on Nordstrom’s guidance for EPS to remain roughly flat in fiscal 2020, Nordstrom stock might appear fairly valued at its recent price of about $33: a little less than 10 times earnings. However, the stock trades for less than seven times the company’s projected 2020 free cash flow. From this perspective, Nordstrom shares are deeply undervalued.

Nordstrom will return most of its free cash flow to shareholders this year, with approximately $225 million of dividends and $300 million-$400 million of buybacks planned. These shareholder returns add up to more than 10% of Nordstrom’s $5 billion market cap. The rest can be used to strengthen Nordstrom’s already-solid balance sheet. In future years, the company could return an even greater proportion of its free cash flow to shareholders.

Between its solid $5 billion off-price business, strong e-commerce presence, and innovative omnichannel initiatives, Nordstrom is well positioned to compete in today’s retail landscape. With free cash flow set to move sharply higher in 2020, the recent slump in Nordstrom stock is a great buying opportunity for long-term investors.

If you enjoyed this article, please scroll up and click the follow button to receive updates on my latest research covering the retail, real estate, airline, and auto industries.

Disclosure: I am/we are long JWN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.