Summary

Starbucks rallies to all-time highs on decent FQ4 results.

The numbers weren’t supportive of a rally due to margin compression.

The stock trades at 25x FY19 EPS forecasts with only 9% growth due to debt influenced buybacks.

After the close yesterday, Starbucks (SBUX) reported some better than expected FQ4 numbers. The question investors have to answer is whether limited comp growth and transaction declines is worthy of all-time highs and a stock trading at 25x current fiscal-year EPS estimates of roughly $2.64. The answer doesn’t appear bullish and doesn’t alter my previous previous research.

Image Source: Starbucks website

Image Source: Starbucks website

Not So Impressive

Despite a difficult period that included the transition away of long-term CEO Howard Schultz, Starbucks reported that the September quarter saw comp sales reach 3.0%. The number beat analyst estimates of 2.4% and were an increase from the weak 1.0% comps in the prior quarter. However, all of the sales gains came from average ticket increases of 4%, offsetting a 1% decline in transactions. For this reason, the numbers were decent, but not necessarily that great.

The market has surprisingly chosen to look past a 190 basis point decline to the operating margin in the quarter. The 18.1% rate for FQ4 was actually slightly above the 18.0% rate for the fiscal year. Making a bull case at all-time highs is very difficult.

The reality is that the guidance for FY19 isn’t that impressive. Starbucks expects revenue growth of only about 6% and more importantly the forecast for EPS is only $2.635 or equivalent to 9% growth. Source: Starbucks FQ4’18 earnings release

Source: Starbucks FQ4’18 earnings release

Not really that impressive for a high-multiple stock.

Too Much Cheer

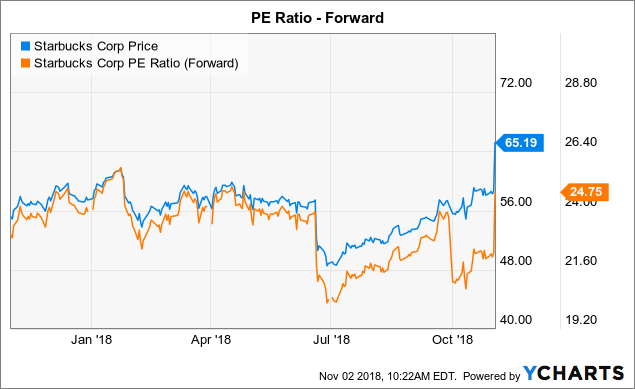

Investors need to take the stock price into the equation. The stock is trading around all-time highs at $65 now. The forward P/E ratio is back toward peak levels of the last year at nearly 25x estimates of about $2.64 per share.

SBUX data by YCharts

SBUX data by YChartsInvestors need to keep in mind that Starbucks returned $8.9 billion to shareholders last year, yet the forecasted EPS growth in rather meager. Large stock buybacks are hiding margin pressures that are hitting the bottom line.

For FY18, Starbucks spent $7.1 billion to repurchase shares. The dividend yield isn’t too impressive at 2.3% now.

The balance sheet isn’t that impressive either. Starbucks has no real cash with a cash and short-term investment balance of about $9.2 billion with net debt of about $9.4 billion. The company has to build the net debt position to keep an aggressive buyback going.

Definitely nothing wrong with such a balance sheet, but investors need to keep in mind that Starbucks repurchased close to 10% of the outstanding shares in the last year at a cost to the balance sheet. The financial outlook would look very weak without these buybacks. In such a scenario, the stock would most definitely trade at 52-week lows.

One only needs to view this list of updated analyst price targets to question why you would want to buy and even hold the stock up here:

- Wells Fargo: $66, up from $64.

- Goldman Sachs: $76, up from $69.

- Morgan Stanley: $64.

The outperform rating from Wells Fargo doesn’t even suggest upside from the initial morning highs.

Takeaway

The key investor takeaway is that Starbucks is a solid, mega-cap stock trading at fast growth multiples. The quarterly results weren’t worthy of a rally to all-time highs.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.