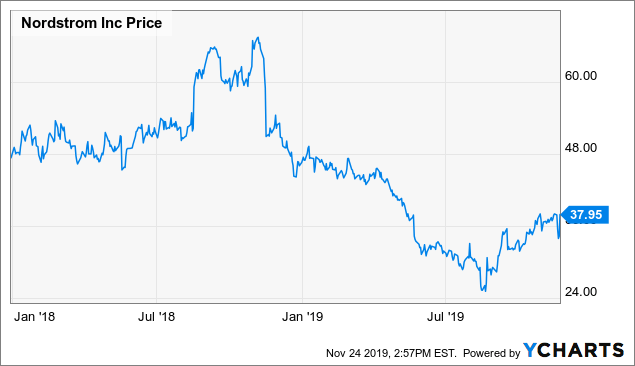

Nordstrom’s stock lost more than half of its value between the fall of 2018 and the summer of 2019, due to a sharp reversal in sales trends.

Fortunately, Nordstrom’s off-price business returned to growth last quarter and the company is starting to stabilize the top line in its full-line segment.

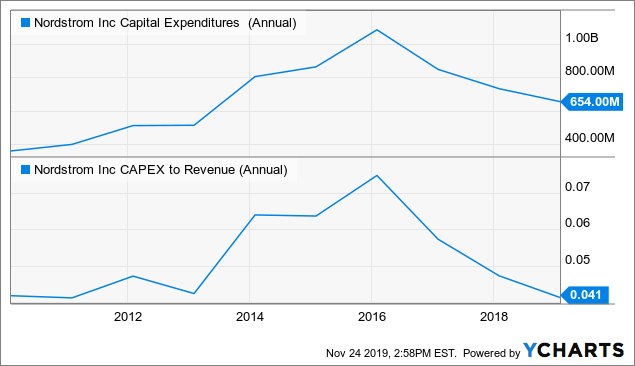

The end of Nordstrom’s heavy investment cycle will pave the way for strong growth in EPS and (especially) free cash flow over the next several years.

Like virtually all of its peers in the department store industry, Nordstrom (JWN) has been a victim of the retail apocalypse over the past few years. It has become increasingly difficult to grow sales, while Nordstrom’s operating margin has been roughly cut in half since 2013.

Nobody can fairly say it was for lack of trying. Since the beginning of 2014, the company has spent about $5 billion on capex (6% of sales, on average). It has invested heavily to improve its technology, roll out new omnichannel capabilities, build out its fulfillment infrastructure, expand into Canada, and accelerate the growth of its off-price Rack business, among other things.

Data by YCharts

Data by YChartsA little over a year ago, Nordstrom seemed to be on the road to recovery. However, it had a major setback in late 2018 and early 2019, as results deteriorated sharply. Fortunately, the retailer got back on track last quarter, potentially setting the stage for a huge rally in Nordstrom stock over the next few years.

A return to growth reverses quickly

Investors may have forgotten this by now, but Nordstrom was reporting healthy growth a little over a year ago. Through the first three quarters of fiscal 2018, comparable sales rose 2.4%, consisting of a 1.9% increase for the full-line business and a 3.4% gain for the faster-growing off-price segment. Total sales grew at a slightly faster rate, mainly due to the opening of additional Nordstrom Rack stores.

That said, sales growth had already started to slow in the full-line business in Q3 2018. This deceleration continued in the fourth quarter, when comp sales declined 1.6% year over year. Even with a 4% comp sales gain on the off-price side, the company’s total comp sales increase for the fourth quarter was a meager 0.1%.

Nordstrom’s performance went further downhill in the first half of fiscal 2019, due to several major execution mistakes. Total sales for its full-line business fell 5.9% year over year. Off-price sales also went into reverse, sinking 1.3%, for a combined sales decline of 4.3%. (Nordstrom stopped reporting comp sales this year.)

The weak sales performance in the first half forced Nordstrom to slash its full-year EPS guidance range from $3.65-$3.90 initially to a range of $3.25-$3.50 by mid-year. This helped send the stock plunging from a high of around $65 a little over a year ago to a low near $25 in August.

Data by YCharts

Data by YChartsInvestors overreacted

The plunge in Nordstrom stock between the fall of 2018 and the summer of 2019 was quite disproportionate to the change in the company’s 2019 earnings projections. This indicated that investors saw the sales slowdown that began in Q4 2018 and accelerated earlier this year as a harbinger of worse things to come. That was a clear overreaction.

In the third quarter, total sales declined by 2.2%, representing a sequential improvement of more than 200 basis points compared to the first half of the year. Full-line sales fell 4.1%, but the off-price business returned to growth, with sales up 1.2% year over year. Additionally, Nordstrom’s adjusted operating margin increased, as improved inventory management boosted gross margin. EPS reached $0.81, compared to adjusted EPS of $0.67 a year earlier: a 21% increase.

Nordstrom also raised the low end of its full-year EPS guidance by $0.05, to $3.30. Its current outlook implies that sales will return to growth in the fourth quarter, driven by the opening of two new stores (most notably, its long-awaited Manhattan flagship store) and improvements to its merchandise selection and marketing strategy. The full-year EPS guidance implies that EPS should come in roughly flat year over year in the fourth quarter.

Investments will start paying off

The sequential slowdown in earnings growth that Nordstrom is projecting for Q4 may seem concerning, but it’s mostly an accounting issue. Nordstrom invested more than $500 million to build its Manhattan flagship store (including capitalized interest), and those capitalized costs are now starting to run through the income statement.

Higher depreciation and amortization expense will remain a headwind through the first three quarters of fiscal 2020. However, offsetting this headwind, Nordstrom won’t incur pre-opening expenses, which represented a significant drag on earnings year-to-date. The company also expects to pare the losses from its other recent «generational investments»: Trunk Club, the expansion into Canada, and the nordstromrack.com off-price e-commerce business.

(The Manhattan flagship’s beauty section. Image source: Nordstrom.)

(The Manhattan flagship’s beauty section. Image source: Nordstrom.)

In fact, Nordstrom expects all of its generational investments combined to reach breakeven by fiscal 2022, compared to a loss of about $135 million this year. Based on Nordstrom’s current share count, that alone would boost annual EPS by more than $0.60.

Should Nordstrom investors fear the retail apocalypse?

Many investors may wonder whether declining mall traffic represents an existential threat to Nordstrom. However, the company is gradually insulating itself from these concerns.

Back in fiscal 2017, the last year for which Nordstrom broke out full-line sales by channel, the company got just under $7 billion of its $15.1 billion in sales from its U.S. full-line stores. That was down from over $7.6 billion in fiscal 2015. Since the beginning of fiscal 2018, Nordstrom has reduced its domestic full-line store count from 117 to 110. Meanwhile, the off-price and digital channels have both grown significantly. As a result, the U.S. full-line stores probably account for no more than 40% of Nordstrom’s revenue today.

That’s still a big enough contribution to weigh on overall sales growth if full-line store sales continue to decline. However, the sales pressure is not equally weighted across all full-line stores. Locations in lower-performing malls have been the biggest drag. For example, the Nordstrom store at MacArthur Center in Norfolk, Virginia (one of seven underperforming locations that closed this year) saw sales tumble from $33 million in 2007 to just $11 million by 2017, with the majority of that drop occurring after 2013.

There will undoubtedly be some additional store closures in the years ahead, but most remaining Nordstrom stores are located in the country’s top malls. Additionally, the opening of the Manhattan flagship will help diversify Nordstrom’s full-line sales base away from suburban malls.

As recently as 2015, Nordstrom got about half of its sales from full-line stores in malls. By 2020, I estimate that it will get just a third of its sales from malls. As the faster-growing e-commerce and off-price channels start to dominate overall sales trends (complemented by full-line flagship stores and stores in top-performing malls that still generate robust traffic), Nordstrom should be able to drive sustainable sales growth, even if overall mall traffic keeps falling.

Free cash flow is about to surge

Perhaps most importantly for shareholders, Nordstrom is about to reach an inflection point for free cash flow. Capex has surged to an estimated $900 million in fiscal 2019, as Nordstrom completed its Manhattan flagship store (and a smaller store in Norwalk, Connecticut) while continuing to invest in its digital, supply chain, and fulfillment capabilities. Meanwhile, losses from its generational investments remain near peak levels.

By contrast, annual capex is set to normalize to $600 million or less in the years ahead. At the same time, the generational investments will move quickly towards breakeven, despite the headwind from higher (non-cash) depreciation and amortization expense. Nordstrom has also made progress on reducing its inventory this year. The closure of lower-productivity full-line stores during 2019 should help in that respect.

At its investor day last year, Nordstrom estimated that free cash flow would rise to around $800 million by fiscal 2020: more than $5 per share. That figure seems quite plausible based on recent sales and earnings trends and the company’s conservative 2020 capex plan. The retailer plans to return virtually all of that cash to shareholders through buybacks and dividends.

Even after an 11% jump last Friday, Nordstrom stock sells for less than $40: less than eight times its projected 2020 free cash flow. That represents an incredibly low valuation. Furthermore, the longer Nordstrom stock remains at a depressed valuation, the faster its EPS could rebound, as the company ramps up buybacks to reduce its share count. Given that Nordstrom is well positioned to weather the general headwinds facing retailers going forward, Nordstrom shares have plenty of room to rise over the next several years.