In the midst of a struggling department store environment, J.C. Penney delivered results which investors saw in a positive light – shares rallied over 5% on Friday.

The company posted comparable stores sales decline of 6.6% while foot traffic continues to slide – customer experience and merchandising was a key area of discussion in Q3.

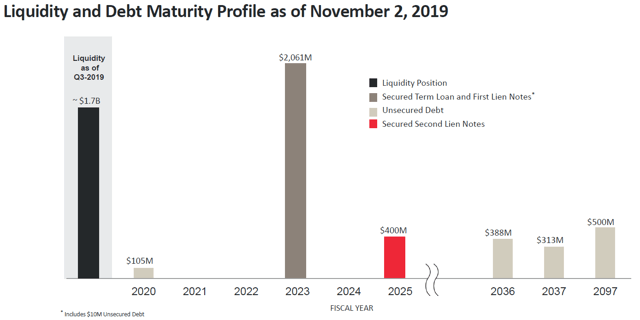

J.C. Penney’s $2 billion debt load continues to inch closer to its 2023 maturity date leaving many analysts and investors cautious.

The company’s debt load is hindering focus on core operations making for unfavorable turnaround prospects – we look to J.C. Penney bonds for opportunities and shy away from the equity.

As the consumer shopping experience becomes increasingly internet-based, brick-and-mortar retailers have been facing headwinds. In the past few years, we have seen historical retailers like Sears and Toys ‘R’ Us close their doors. Declining foot traffic across department stores like J.C. Penney (JCP) have resulted in dwindling revenue and comparable store sales.

Source: CoStar

In Q3, management noted various efforts being made in merchandising and the customer experience which we believe has been heavily neglected. In addition to drilling down into their customer base, J.C. Penney has put some thought into the future of their business by focusing on channels beyond brick-and-mortar retail.

Yet due to their leveraged balance sheet and secular industry headwinds, we’re not large fans of the company’s equity. On the other hand, we see a potentially attractive opportunity for investors in the company’s debt – specifically their 8.625% bonds with a 2025 maturity.

Quarter Highlights: What We Think

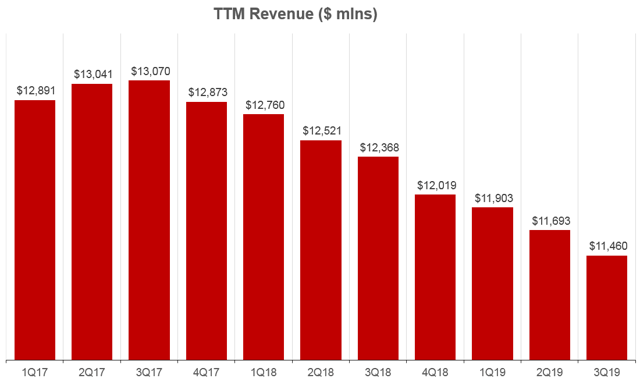

In the quarter, J.C. Penney reported revenue of $2.5 billion ($2.4B ex-credit income). On a trailing twelve-month basis this was ~$11.5 billion. Revenue declined 10.1% year-on-year, while comparable store sales declined by 6.6% (adjusted for impact from appliances and furniture). Industry-wide headwinds continue to pressure the department store while the company’s new management team attempts to navigate the choppy waters.

Source: QuickFS

Source: QuickFS

Looking further down the road, we don’t expect the retail environment to change in J.C. Penney’s favor – we believe the company, with a relatively inferior online shopping experience, should allocate some time into improving their online offering. Luckily, management has mentioned these efforts in the Q3 earnings call:

We’ve also been working on just the frictionless and seamless effort to shop cross functionally between our digital and our physical space. And as I mentioned, our customers will continue to feel the impact of our efforts over time. As we can do this a little bit more quickly and in real-time and faster. And we have a full organization focus on improving our mobile web, our website as well as our app.

Source: 3Q19 Earnings Call

The focus on a low-friction experience is important when it comes to driving sales volume and customer satisfaction. Although we commend the progress being made, we also believe there is a lot of work to be done. Merely focusing on the digital side of things is not enough – the company will have to find solutions to compete with fast delivery offered by other retail peers.

When it comes to the in-store customer experience, management has long touted a dedication to improving it, but little progress has been made until now. The company spoke about their «brand defining» store which is quite impressive. The store includes attracting features such as a Disney (DIS) shop, cafe and bistro, lounges, and a movement studio (with fitness classes). Management emphasizes that this does not represent a prototype store to be rolled out, but resembles more of a lab which provides valuable data which can in turn be used in stores.

The hard part is expending resources across all channels given J.C. Penney’s tight financial position. On the online side, it’s difficult to provide a competitive customer experience given the CAPEX heavy nature of building out a proprietary operation. This leaves them with the option of finding third-party fulfillment providers. This also applies to store improvements which require capital. We’ll discuss the company’s debt in the next section, but with high servicing costs it takes away the company’s ability to focus on core operations – this is a theme being seen in many retailers today.

As GlobalData managing director Neil Saunders put it:

The question is whether it has the resource and energy to complete its journey. There is a slim chance it can make it if it manages to improve underlying trading by enough to stabilize losses and undertakes a gradual brand reinvention, using online to bolster sales. However, sadly, in our view, the odds are firmly stacked against it.

Source: MarketWatch

Opportunity in the Debt?

Looking back into debt, the company has over $2 billion maturing in 2023 primarily from their first lien notes and term loan. In a previous article we mentioned that the near-term risk of bankruptcy was low in our eyes – however, looking beyond this 2023 time line there is a significant amount of uncertainty.

Source: Company Filings

Source: Company Filings

Even with all this uncertainty, we continue to believe that in the event of a liquidation bondholders of the 2025 8.625% bonds would see a recovery rate of (or close to) 100%. The bonds are currently trading at just over 60 cents on the dollar.

Source: FINRA

Sure, there can be a large payout for equity holders should a turnaround be successful. However, we see a more favorable opportunity in the company’s debt (from a risk-reward standpoint). Unless a restructuring or refinancing event were to take place, we believe the company’s debt is where opportunity lies. For investors interested in a high-yield opportunity, the 2025 8.625% notes seem like a worthwhile bet to make.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.